Standby Letter of Credit (SBLC)

Overview of Standby Letters of Credit

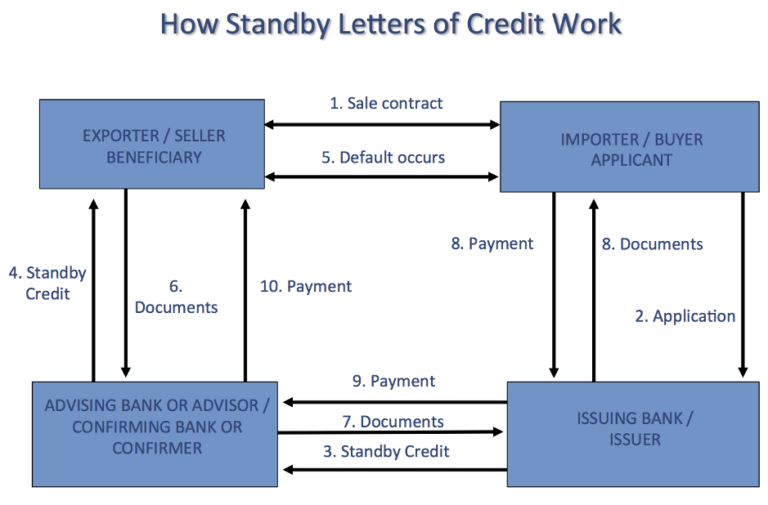

A Standby Letter of Credit (SBLC) is a crucial financial tool used primarily in international trade to provide an added layer of security for transactions. An SBLC guarantees payment to a beneficiary if the buyer (applicant) fails to fulfill their financial obligations as stipulated in the contract. This financial instrument is issued by the applicant's bank, ensuring that sellers receive payment even in the event of non-payment from the buyer.

Key Features of Our SBLC Services:

- Risk Mitigation: The SBLC acts as a safety net for sellers in international trade, providing payment assurance which can be crucial when dealing with new or distant trading partners.

- Flexibility: Beneficiaries can assign the proceeds of an SBLC, although the rights associated with making a demand for payment remain solely with the original beneficiary unless explicitly stated otherwise in the terms of the SBLC.

- Clear Terms: The conditions under which an SBLC can be drawn are clearly defined, ensuring all parties understand the circumstances and legal framework involved.

Participants in the SBLC Process:

- The Applicant: The customer who requests the SBLC from their bank. They must have sufficient creditworthiness or provide collateral to secure the issuance of the SBLC.

- The Issuing Bank: The bank that issues the SBLC on behalf of the applicant, guaranteeing payment to the beneficiary under the terms agreed.

- The Beneficiary: The recipient of the SBLC, usually the seller in a trade transaction, who has the right to demand payment if the applicant fails to meet the contractual obligations.

- The Confirming Bank: Often located near the beneficiary, this bank may agree to guarantee payment, providing additional assurance to the beneficiary.

- The Advising Bank: Represents the beneficiary by advising them on the terms of the SBLC and assisting in the payment process, ensuring the transaction remains secure within the banking system.

Why Choose PANCOWINC for Your SBLC Needs?

- Expert Guidance: Our team of financial experts provides comprehensive support and guidance throughout the SBLC process, from application to closure.

- Customized Solutions: We understand that each business has unique needs. Our services are tailored to meet the specific requirements of your trade transactions, ensuring optimal financial security.

- Global Network: Leveraging our vast network of international banks and financial institutions, we can facilitate the issuance of SBLCs efficiently, regardless of your trading partner's location.

At PANCOWINC, we are dedicated to enhancing your business transactions with reliable, secure, and efficient financial instruments like the Standby Letter of Credit. Whether you are looking to expand your business globally or secure your international trade dealings, our SBLC services are designed to support your growth and ensure peace of mind in every transaction.

Contact Us

Crafted Excellence in Corporate Advisory and Financial Consultancy, Empowering Growth and Stability.

Our Location

202 Part A, Amrit Apartment, Chadha Complex, Lajpat Nagar, Jalandhar, 144001, Punjab, India