Debt Syndication Service

Understanding Debt Syndication

Debt syndication is a financial arrangement where multiple banks or financial institutions come together to provide a borrower with a credit facility under common debt documentation. This approach is typically used for managing large loans that might be beyond the capacity of a single lender, especially in scenarios aiming to fund significant corporate ventures or prevent corporate bankruptcy.

How Debt Syndication Works

Debt syndication involves the distribution of loan amounts among several entities—banks, investment firms, or other financial institutions—allowing these entities to share both the profits and risks associated with large loans. This method is particularly appealing in today's financial climate where the number of available lenders has diminished, and banks have become more cautious about engaging in high-risk investments.

Key Benefits of Debt Syndication

- Risk Distribution: By spreading the loan across multiple lenders, each participant reduces their individual risk exposure.

- Capital Accessibility: It allows companies to access larger sums of money than might be available from a single source, enabling significant business moves like expansions, acquisitions, or bridging working capital gaps.

- Structured Financing: We specialize in crafting tailored financial products that meet specific corporate needs, whether for short-term or long-term funding.

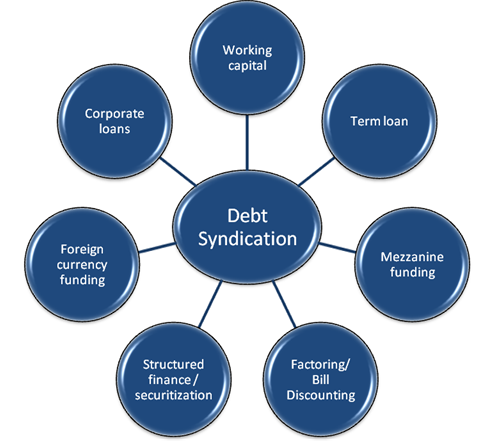

Our Debt Syndication Services Include

- Project Financing: Providing funding for new projects or expansions tailored to the specific needs and risk profiles of the business.

- Working Capital Financing: Structuring loans to ensure your business can continue smooth operations without liquidity issues.

- Acquisition Financing: Arranging the necessary capital for mergers and acquisitions, facilitating corporate growth and market expansion.

The Role of PANCOWINC in Debt Syndication

At PANCOWINC, we act not only as facilitators in arranging these complex deals but also as key principals in structuring the agreements. Our deep relationships with a broad spectrum of financial institutions enable us to effectively syndicate debt for various business requirements. Our expertise extends to negotiating terms that align with our clients' strategic financial goals, ensuring a balanced approach to risk and reward.

Collaborative Approach

In addition to traditional banking partners, we collaborate with investment companies, securities firms, insurance companies, credit unions, and individual investors to form a comprehensive syndicate capable of funding substantial loans. This collaborative approach not only diversifies the risk but also enhances the financial robustness of the debt arrangement.

Choose PANCOWINC for Your Debt Syndication Needs

Whether your company is looking to fund expansive projects, require substantial working capital, or aim to execute strategic acquisitions, PANCOWINC’s debt syndication services are designed to support your ambitions. We ensure that the financial structures we implement are optimal for your specific business context, helping you to achieve sustainable growth and financial stability.

Contact Us

Crafted Excellence in Corporate Advisory and Financial Consultancy, Empowering Growth and Stability.

Our Location

202 Part A, Amrit Apartment, Chadha Complex, Lajpat Nagar, Jalandhar, 144001, Punjab, India